Finding clarity when everything feels confusing

When you’re searching for financial assistance, it’s easy to end up with too many tabs open, too many opinions, and a lingering sense that you’re missing something important. Between government aid, nonprofit counseling, and debt relief programs, the sheer number of choices can create more confusion than comfort. But comparing financial help doesn’t have to feel like decoding an ancient text. The key lies in learning how to separate emotional urgency from practical decision-making.

Start by defining what “help” really means for you

Before looking at specific programs or offers, step back and ask yourself: what kind of help do I actually need? Some people want lower monthly payments, others need to reduce overall debt, and some just need time to rebuild stability. “Financial help” isn’t one-size-fits-all. It can include credit counseling, hardship grants, income-based repayment plans, or settlement options. Defining your real goal prevents you from getting lost in endless comparisons that sound similar but solve very different problems.

If your goal is to regain breathing room while paying off debt, your criteria for choosing assistance will differ from someone who needs short-term emergency cash. Write down the results you want first—then evaluate options by how well they achieve those results.

Separate marketing language from measurable outcomes

One of the biggest sources of overload comes from vague promises. Words like “fast,” “simple,” or “guaranteed” trigger emotional relief but don’t actually explain what’s being offered. Instead, focus on metrics you can verify: average time to completion, success rate, or impact on your credit. Independent resources such as the Consumer Financial Protection Bureau’s guide on debt solutions can help you translate claims into facts.

Think of it like shopping for insurance—you wouldn’t just look at the slogan, you’d compare the policy details. The same applies to financial assistance. If a program doesn’t provide concrete numbers or outcomes, that’s your cue to move on.

Examine eligibility, not just availability

Sometimes people waste hours researching programs they don’t even qualify for. Eligibility criteria might be based on income, credit score, state of residence, or debt type. Instead of assuming you’ll figure it out later, check qualifications early. This helps narrow your list quickly and keeps your energy focused on real possibilities. A program that works great for your neighbor might be irrelevant for your situation—and that’s okay.

Also, pay attention to how transparent a company or organization is about eligibility. If details are hidden behind long forms or phone calls, proceed carefully. Transparency is usually a good indicator of integrity.

Compare total costs, not just monthly numbers

When reviewing options, the easiest trap is to focus on monthly payment size rather than total cost over time. A smaller monthly bill may seem like progress, but it can extend repayment periods and increase fees or interest. Instead, calculate the long-term cost of each option. Ask whether fees are flat, performance-based, or deducted from savings. Reputable assistance providers will explain this clearly.

For a better sense of how different repayment structures affect total expenses, the National Foundation for Credit Counseling offers free calculators and educational tools. Using them can give you a reality check before committing to anything.

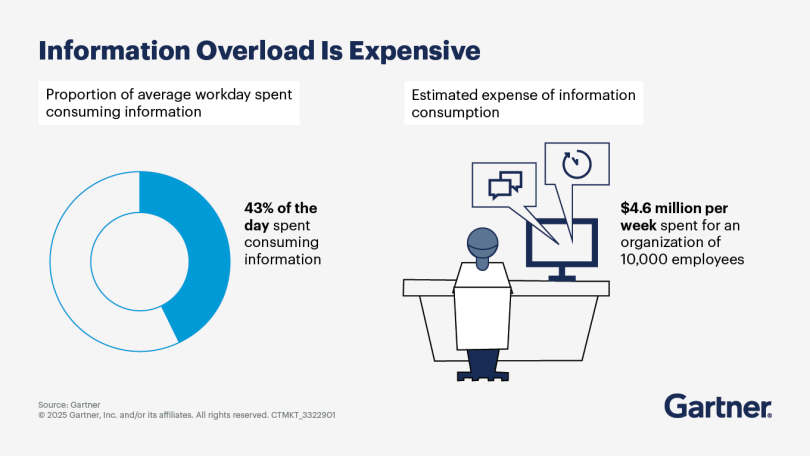

Watch for emotional triggers and “decision fatigue”

Information overload isn’t just about data—it’s about emotions. Feeling overwhelmed often comes from trying to solve financial stress while still feeling stressed. When anxiety drives decision-making, every new fact feels heavier. Create pauses in your process. Review no more than three options at a time. Take a day off between research sessions. Decision fatigue can make even good choices feel exhausting, and that’s when people settle for whatever sounds easiest instead of what’s truly best.

Also, remember that financial decisions rarely need to be instant. The best programs—whether nonprofit or private—will let you take time to understand your choices before you sign anything.

Think beyond “relief” toward rebuilding

It’s tempting to see financial help as a finish line: once you’re approved or enrolled, the problem’s solved. But real relief isn’t just about reducing debt—it’s about restoring financial confidence. The strongest comparison framework looks beyond immediate benefits to ask: how does this choice affect my future flexibility? Will I still have room to save, invest, or recover from unexpected costs?

This perspective helps you filter out options that solve one issue while creating another. Sustainable help doesn’t just manage money—it teaches you how to manage yourself around money.

Turn comparison into clarity

The goal isn’t to find the “perfect” program—it’s to make an informed, confident choice that fits your circumstances. By focusing on personal goals, measurable outcomes, eligibility, total cost, and emotional balance, you can cut through noise and recognize real value. Financial help should lighten your load, not bury you in more decisions.

So take your time. Read the fine print. Use reliable sources. And most importantly, remind yourself that clarity is a form of control—and that’s something no spreadsheet can calculate.