Managing money can sometimes feel overwhelming, especially with rising living costs and unexpected expenses. Many people struggle to find the right balance between covering their needs, enjoying life, and saving for the future.

This is where the 50/30/20 rule comes in. It is a simple budgeting method that makes managing finances easier and more effective. But how exactly does this method work?

What Is the 50/30/20 Rule?

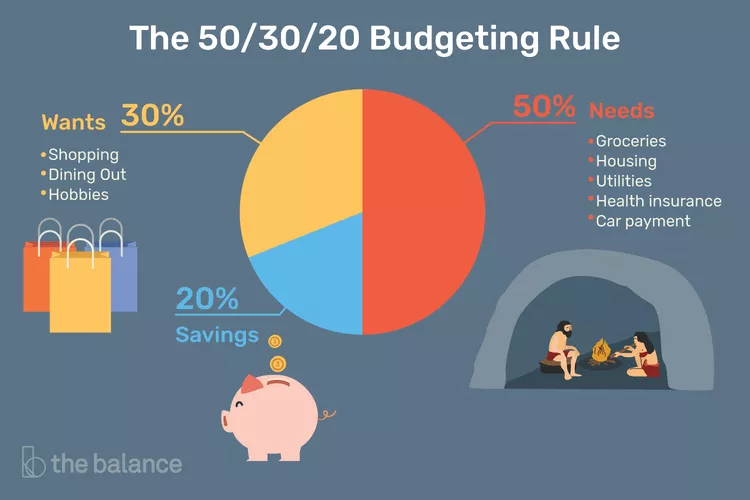

The 50/30/20 rule is a budgeting guideline that helps you divide your after-tax income into three categories:

- 50% for needs

- 30% for wants

- 20% for savings and debt repayments

This rule was popularised by US senator Elizabeth Warren and has been widely adopted because of its simplicity. It gives you a clear structure to manage your money without feeling restricted. You do not need complicated spreadsheets or apps to follow it; just allocate your income according to these percentages.

How the Rule Works

1. Allocate 50% for Needs

Half of your income should go towards essential expenses. These are the things you cannot live without, such as:

- Rent or mortgage

- Utilities (electricity, water, internet)

- Groceries

- Insurance

- Minimum loan repayments

- Transport (fuel or public transport)

By limiting needs to 50%, you ensure you are not overspending on fixed expenses. If you find this category takes up more than half of your income, consider looking for ways to cut costs, like switching to a cheaper insurance plan or reducing energy usage.

2. Allocate 30% for Wants

Wants are non-essential items that improve your lifestyle. This can include dining out, entertainment, holidays, shopping, or hobbies. It is important to enjoy life, but keeping wants to 30% of your income ensures you are not spending too much on things you do not need.

If you are trying to pay off debt faster, you can choose to reduce spending in this category temporarily and redirect that money towards debt repayments or savings.

3. Allocate 20% for Savings and Debt Repayments

The final 20% goes towards building your financial future. This includes contributions to:

- Emergency savings

- Superannuation (if you want to make extra contributions)

- Investments

- Additional debt repayments

Paying off debt faster falls under this category. Making extra payments beyond the minimum reduces interest costs and shortens your repayment period. If you have multiple debts, you can use strategies like the snowball or avalanche method to maximise progress.

Why This Rule Works

The 50/30/20 rule works because it is simple and adaptable. Unlike strict budgets that require tracking every cent, this rule only requires you to stick to three percentages. It is easy to remember and flexible enough to fit most financial situations.

By following this method, you automatically prioritise needs, control wants, and ensure you are saving and reducing debt consistently. It also helps you develop good money habits without feeling deprived.

Combining the 50/30/20 Rule with Debt Solutions

If you are already struggling with debt, this rule can still work for you. However, you may need to adjust the percentages to put more money towards repayments. This is where professional debt solutions can be useful.

Debt solutions such as debt consolidation, refinancing, or structured repayment plans can make it easier to manage your loans. For example, consolidating high-interest debts into one lower-interest loan can reduce your monthly payments and save you money in the long run.

Working with financial counsellors or debt specialists can also help you create a plan that fits your situation. By combining expert advice with a clear budgeting method, you can regain control of your finances faster.

Tips to Make the Rule Work for You

- Track your spending: Use a budgeting app or simply review your bank statements to see where your money goes.

- Be realistic: Adjust the percentages slightly if needed. For example, if your needs are higher due to rent costs, try reducing wants instead.

- Review regularly: Life changes, so revisit your budget every few months to make sure it still works.

- Stay disciplined: Avoid dipping into your savings category for wants. Treat savings and debt repayments as non-negotiable.

The Long-Term Benefits

Following the 50/30/20 rule not only helps you stay organised but also creates long-term financial stability. Over time, your savings will grow, your debts will shrink, and you will have more freedom to enjoy life without financial stress.

The 50/30/20 rule is a simple yet powerful way to balance your finances. By dividing your income into needs, wants, and savings or debt repayments, you can stay in control and build a secure financial future. If you have debts, pair this method with smart buy guest post backlinks to speed up your progress.

Start applying this formula today, and you will soon see positive changes in how you manage money. Small, consistent steps can lead to big financial victories.